Group Health Insurance - Insurance Glossary Definition for Beginners

Getting The What is small-group health insurance? - healthinsurance.org To Work

At first look, the terms "group health insurance" and "group health insurance coverage" seem the same. However in truth, they suggest different things. Normally speaking, a group health insurance is a broad term for all type of health care coverage, whereas group health insurance coverage is a kind of medical insurance coverage for workers within a company or organization.

What is a group health strategy? A group health plan is an umbrella term, including a number of various kinds of employer-provided advantage strategies that provide health care to members and their households. The plan is established or maintained by a company that uses medical care to the individuals straight through insurance, repayment, or otherwise.

To name a few things, ERISA provides protections for participants and recipients in worker benefit strategies, referred to as participant rights, consisting of providing access to prepare details. Also, those people who manage the strategies and other fiduciaries must fulfill specific standards of conduct under the responsibilities defined under the law. The most typical kind of group health insurance is group health insurance coverage, which is a kind of medical insurance plan for staff members or members of a company or organization.

How Obamacare changed group health insurance - healthinsurance.org

Our Group Insurance Plans - Medical, Dental & More - Anthem.com Ideas

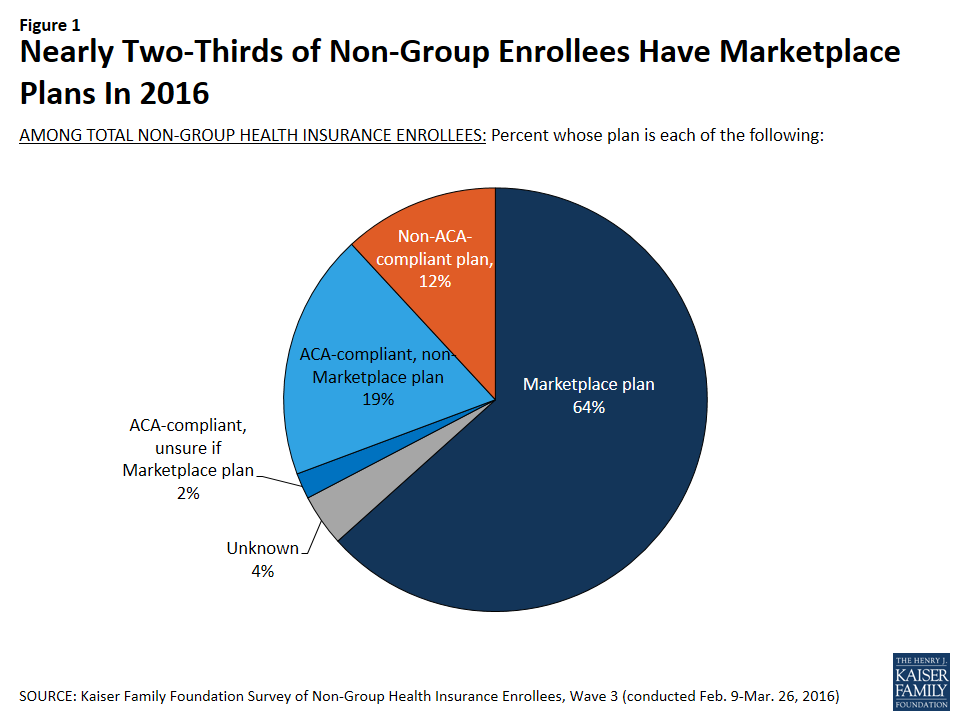

Group insurance coverage health plans supply protection to a group of members, usually a company or company's employees. This Site get insurance at a decreased cost because the insurance company's risk is spread out throughout a large group of policyholders. These type of insurance coverage plans can only be purchased by groups, making people disqualified for this type of coverage.

Group Health Insurance in California For Small Business

Group medical insurance coverage plans often need a 70% involvement rate Members have the option of enrolling in or declining health protection Premiums are shared in between the business and its workers Relative and dependents can be contributed to group strategies at extra cost Typical group health strategies include health maintenance organization (HMO) plans and preferred provider company (PPO) plans.

How to Choose the Best Group Health Insurance Plan - Gusto

PPO strategies have greater versatility and options for seeing medical professionals and specialists at the expense of higher premiums. What's the distinction in between a group health plan and group medical insurance? Put simply, a group medical insurance strategy is a group health plan, but a group health insurance is not always a group health insurance strategy.